MORTGAGE CALCULATOR

Mortgage Info

Down Payment

The typical rule of thumb is to pay 20 percent of the home's price as your down payment (to avoid additional costs), although you can put as little as 3-3.5% down. Your down payment reduces the total amount of your mortgage loan, so the more money you put down, the lower your payments will be; or the more expensive a house you can buy.

Loan Term

Your loan program can affect your interest rate and monthly payments. Choose from 30-year fixed, 15-year fixed, and more in the calculator.

Loan Type

There are several types of mortgage loans, but the most commonly used are fixed-rate and adjustable-rate loans. Fixed-rate loans have the same interest rate for the entire duration of the loan. That means your monthly payment will be the same, even for long-term loans, such as 30-year fixed-rate mortgages. Two benefits to this loan type are stability, and being able to calculate your total interest up front. Adjustable-rate mortgages (ARMs) have interest rates that can change over time. Typically they start out at a lower interest rate than a fixed-rate loan, and hold that rate for a set number of years, before changing interest rates from year to year. For example, if you have a 5/1 ARM, you will have the same interest rate for the first 5 years, and then your interest rate will change from year to year. The main benefit of an adjustable-rate loan is starting off with a lower interest rate.

Interest Rate

This field is pre-filled with the current average mortgage rate. Your actual rate will vary based on factors like credit score and down payment. Contact your lender for more specific details.

Property Tax Rate

The mortgage payment calculator includes estimated property taxes based on the home's value. You can edit this in the advanced options.

Home Insurance

Home insurance or homeowners insurance is typically required by lenders, depending on the loan program. You can edit this number in the mortgage calculator advanced options.

HOA Fees

A homeowners association fee (HOA fee) is an amount of money that must be paid monthly by owners of certain types of residential properties, and HOAs collect these fees to assist with maintaining and improving properties in the association.

Handy Definitions:

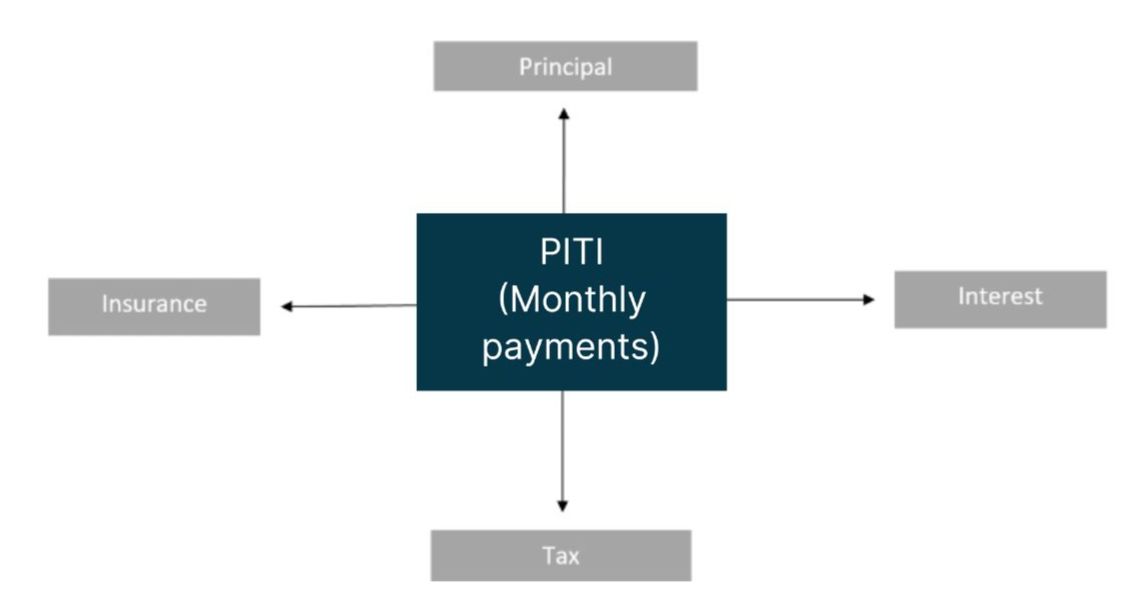

Principle:

The portion of your payment that goes towards reducing the balance of the loan.

Interest:

The portion of your payment that goes to the bank for borrowing their money. This can be fixed or adjustable, depending on the loan you choose.

Taxes:

The portion of your payment that goes to the local & county governments. It is 1/12th of your annual property tax bill. The bank will hold this amount in an "escrow" account to pay the bill when it comes due. This amount can vary GREATLY. If a house has a very high tax bill, it may be out of your budget. Real Estate taxes can drastically effect the purchase price you qualify for.

Insurance:

Homeowners' Insurance:

The portion of your payment that the bank holds in an "escrow" account to pay the bill when it comes due. This is the policy that covers loss or damage to your home. The cost of the policy varies depending on the level of coverage you choose.

Mortgage Insurance - AKA...PMI or MIP:

If you put down less than 20% or elected to get an FHA mortgage, you'll pay mortgage insurance. This insures the LENDER for their losses if they ever have to foreclose.

10 Common Questions Lenders Hear...

Do I need to put 20% Down to buy a home?

No. It is not required. The industry average for 1st time buyers in 2020 was 7%. (source: NAR 2020 report)

What is PMI?

Private Mortgage Insurance. PMI is required if you have less than 20% down payment. This protects the lender against financial loss if the loan is defaulted.

Are there any other costs besides my down payment?

You will have to pay for closing costs, appraisal, and the first year premium for homeowner’s hazard insurance. All money besides the up-front earnest money, home inspection fees and the appraisal fee are paid at the closing table with your down payment.

I just started my job, does my income count?

If you are a salary employee with a W2, you can count your income immediately upon the start date. However, if you are commissioned, receive bonuses, or are self employed, you will need a 2 year history of what is claimed on your tax returns.

What is the difference between a fixed rate and an adjustable rate mortgage?

With a fixed rate mortgage, the interest rate & principle/interest portion of the payment does not change. With an adjustable rate mortgage (ARM), the interest rate & principle/interest portion of the payment can either increase or decrease, based on the terms of the loan.

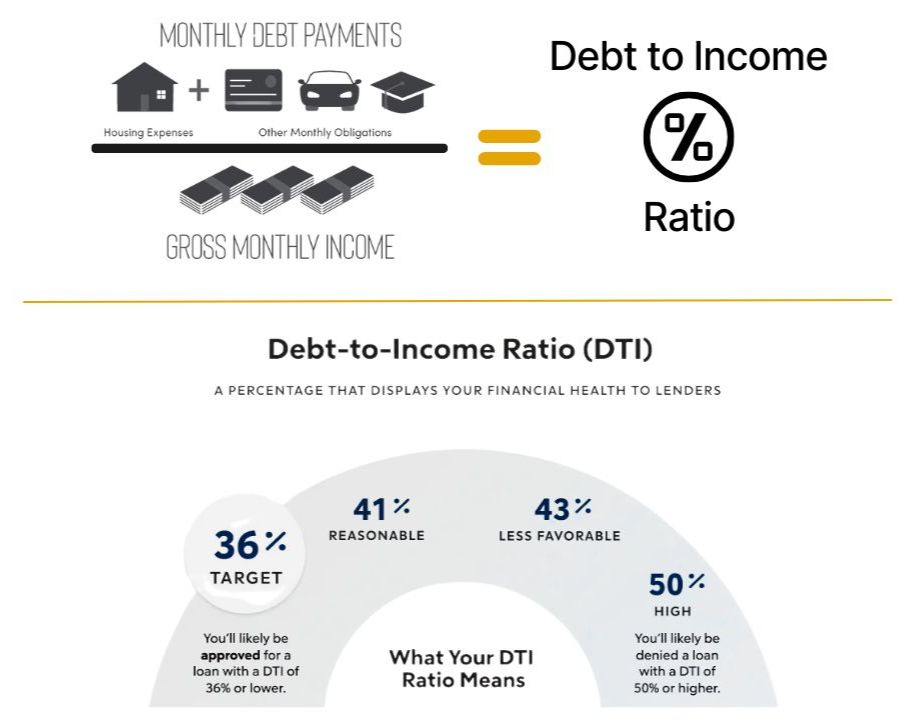

How will the purchase price affect my mortgage payment?

Understanding each portion of the payment is important - from the principle & interest to taxes, insurance, association fees & more. The down payment will reduce the purchase price and create your loan amount. The more you put down, the lower amount you are borrowing; therefore your payment will be less (payment is always based on loan amount, but other factors like taxes will make a difference too).

What documents do I need to apply for a mortgage?

You will need your social security number, 30 days of paystubs, past 2 year’s Tax Returns & W2's, bank statements, and an executed purchase contract

How long does the mortgage process take?

This can vary depending on whether we have all the documents required, but on average takes about 30-45 days

How will my credit score be viewed/used?

Your credit report will be used to evaluate your mortgage request and determine how you have handled past credit obligations. You can obtain a free credit report every year at www.annualcreditreport.com

How do interest rates affect mortgage payments?

Rates can change daily. considering the payment over purchase price will assist you in planning for possible increases or decreases in rates and how that would change your payment.

Mortgage Approval Process

- Application & Document Collection

If you haven’t already, you’ll be prompted to complete the formal application. The lender will also start collecting the necessary documentation for the approval process.

- Appraisal

Once we have completed the inspection & know we are ready to move forward, our lender will order the appraisal. The appraiser has 10 days to visit the property and complete their analysis. We will be notified once the appraisal has been completed & if there are any issues with the purchase price on the contract or if any repairs are needed based on your loan type (FHA/VA).

- Processing & Underwriting

Any missing documentation will be requested. The FASTER you provide the documents the lender needs, the faster the approval process will move along. Once ALL documents (including the appraisal) have been obtained, your file will be submitted to underwriting to be analyzed with a fine-tooth comb!

- Conditional Approval

Once the underwriter has gone through the file initially, there will (inevitably) be some conditions that need to be cleared before there is a final approval. Example? They could be missing page 4 of 5 on a particular bank statement or need an explanation for inquiries on your credit report. Once you submit the conditions, you’ll be sent in for final approval.

- CLEAR TO CLOSE!!!

These are the magic words! Once we get this notice, we are ready to schedule the closing. You will also receive the final figures through what’s called the Closing Disclosure. This tells you exactly how much you need to bring to closing for down payment/closing costs.