What Credit Score Do You Really Need To Buy a Home?

Think Your Credit Score Isn’t Good Enough to Buy a Home? Think Again, Fox Valley!

If you’ve been scrolling Zillow from your couch in Algonquin, grabbing coffee in Elgin, or driving past those charming Dundee or Crystal Lake homes thinking, “I wish… but my credit score isn’t high enough”—pause right there.

According to Fannie Mae, 90% of buyers either don’t know the credit score lenders look for or totally overestimate it. Translation? Most homebuyers think they need a gold-plated, perfect score before they can even dream of homeownership. Spoiler: They don’t.

That means you could be closer to unlocking the door to your dream home than you think.

There’s No One Magic Number

Here’s the deal: there’s no single “secret score” that works for every home loan.

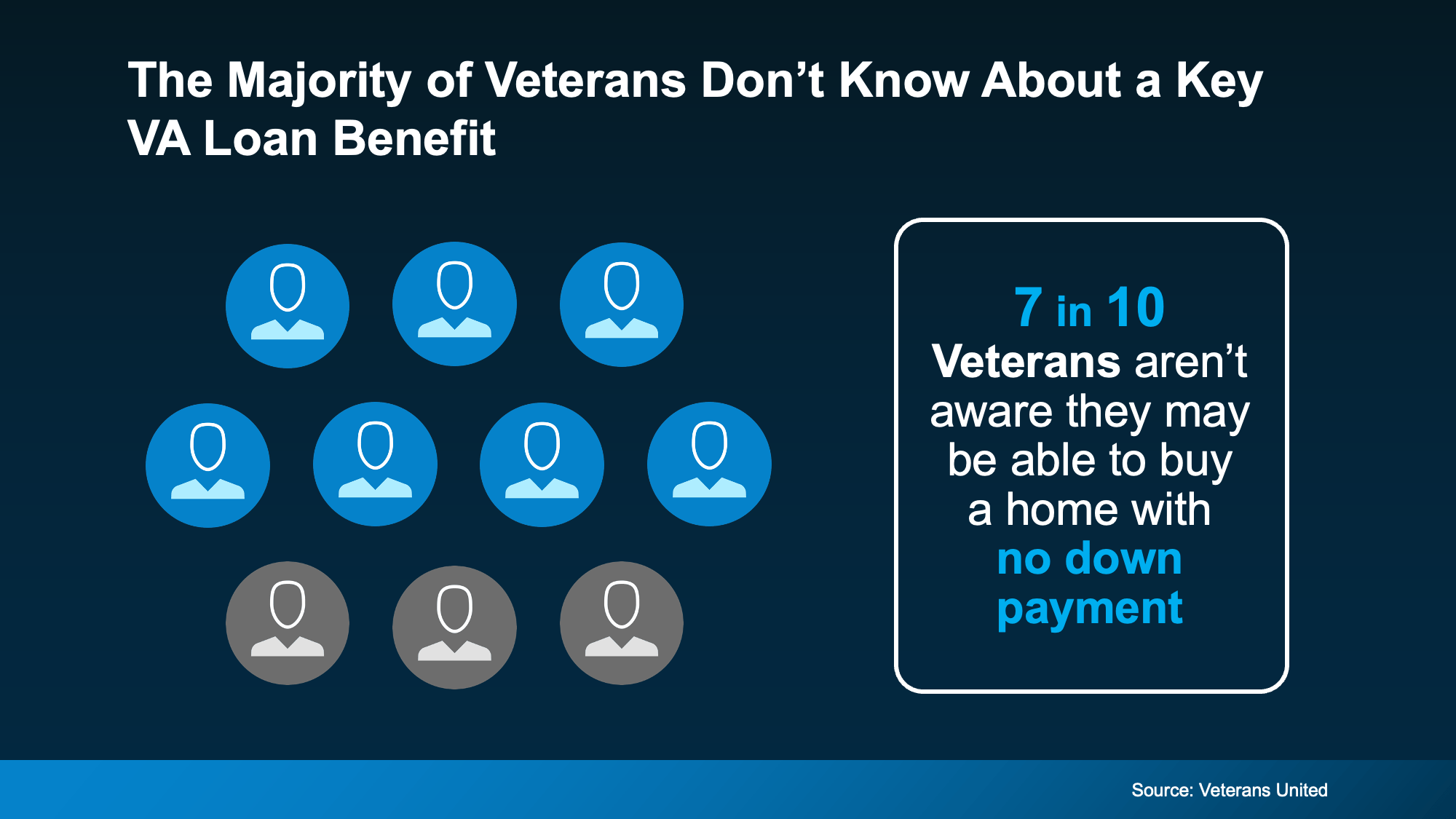

Different loan programs (think FHA, VA, and conventional loans) each have their own range, and they aren’t as out-of-reach as most people imagine. That’s why your neighbor in West Dundee might have qualified for a mortgage with a different score than your co-worker in Lake in the Hills.

As FICO puts it:

“There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use…”

Bottom line: If you want to know where you stand, talk to a local lender who knows the Fox Valley market. They’ll help match your situation to the right program—sometimes even when you think your score is “too low.”

Why Your Score Still Matters

Don’t get me wrong—your credit score does matter. Lenders look at it to see how reliable you’ve been with money (think paying bills on time, managing debt, etc.).

Here’s why it’s important:

-

It can affect which loan programs you qualify for.

-

It influences the interest rate you’re offered.

-

And since your interest rate impacts your monthly payment, it plays a big role in how much house you can afford (that Crystal Lake dream home on the lake might suddenly become more realistic).

As Bankrate explains:

“Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

Translation: Better score = better terms = more house for your money.

Want To Boost Your Score? Start Here

If you find your credit could use a little TLC before making an offer on that Dundee bungalow or Algonquin townhouse, the Federal Reserve Board suggests:

-

Pay Your Bills on Time – This is huge. From your credit card to your cell phone bill, consistent on-time payments show lenders you’re dependable.

-

Pay Down Debt – Keep your balances low. A smaller debt-to-credit ratio makes you look like a low-risk borrower.

-

Review Your Credit Report – Mistakes happen! Check for errors and dispute anything that’s incorrect.

-

Avoid Opening New Accounts – It can be tempting to grab that “store discount card,” but each new account can trigger a hard inquiry that dings your score temporarily.

The Bottom Line for Fox Valley Buyers

Your credit score doesn’t need to be flawless to buy a home in Algonquin, Elgin, Dundee, Crystal Lake or surrounding areas. You might be far closer to qualifying than you think. The smartest move? Connect with a trusted local lender to see where you stand. You might just be opening the door to your new home sooner than you ever imagined.

And when you’re ready to house hunt? The Jones Team at Baird & Warner knows these neighborhoods like the back of our hand—we’ll help you find the perfect fit.

👉 Thinking about buying? Let’s chat. Whether you’re ready now or planning for the future, we can help you take the next step—credit score worries and all.

Categories

Recent Posts

It's EASIER to Move When The Jones Team Has Your Back!

+1(847) 654-9776 | jones.team@bairdwarner.com